Overview

We believe that Nouns DAOs are the most promising model for allowing anyone online to organize around any shared idea. DAOs center community engagement and collective decision-making, and are operationally transparent in a way that existing organizations simply are not. Nouns DAOs demonstrate the next evolution of this, with onchain governance, distributed membership by design through the auction model, and alignment of incentives and a common purpose among DAO participants. In a Nounish DAO, DAO members put in the work and are the real decision-makers.

It’s this belief that drove Zora to develop the Nouns Builder Protocol, and it’s why we’ve continued to dedicate so much of our time and energy developing tools and resources to support Nounish DAO creation and participation. Builder DAO was founded to cede the development of the Nouns Builder Protocol and brand to the Builder community, expand and distribute this technological infrastructure as a public good, and further proliferate the development of Nounish DAOs and related projects. Since the DAO’s launch, it’s been great to see the level of engagement and quality of projects being proposed and funded in support of these purposes.

We also recognize DAO members’ questions and concerns as the implications of the DAO’s structure as a US entity (specifically an Unincorporated Nonprofit Association, or “UNA”) and related tax payment and information collection obligations became fully apparent.

This post outlines why Zora proposed the US-based UNA model for Builder DAO, the research we did prior to making this recommendation, and the next steps the DAO and its members can take to address any outstanding concerns.

Research Process

Before diving into the weeds, we wanted to provide some background on our research process. Zora began considering launching Builder DAO over six months ago. Since then, we have consulted with numerous accountants and lawyers (including the same teams who advised Nouns) and other prominent DAOs, VCs, and advisors, have read every paper on DAO risk out there, and reviewed regulatory actions involving DAOs, including the ongoing OokiDAO matter.

We analyzed our research through two lenses:

- What DAO structure makes sense for BuilderDAO

- What DAO structures make sense for other DAOs/Protocol users given their circumstances. This would expand on high level guidance we’ve provided here.

We expended significant time and resources on this process because Zora believes it is important to ensure that the DAO achieves its operational priorities and conducts itself in a risk-managed and legally compliant manner. Doing so best positions the DAO and the Protocol for long term growth and success, and helps avoid the pitfalls we’ve seen far too often in this space when teams cut corners.

Intended DAO Characteristics

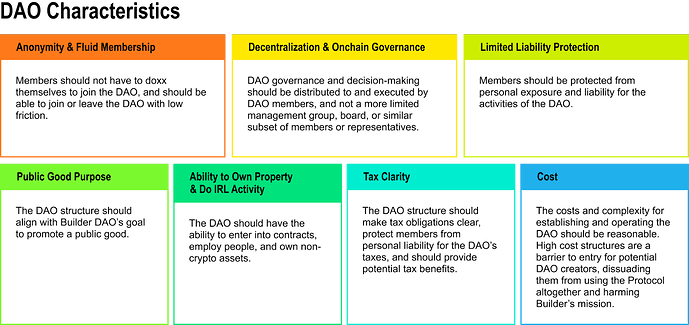

In our analysis, we prioritized the following:

Importantly, given Builder DAO’s public good purpose (and to address securities law risk), we did not prioritize token holders receiving an ownership right or profit distribution in the DAO’s assets or revenues.

Assumption of US Activity

As part of our analysis, we operated under the assumption that the DAO would have material US presence. While we recognize that some DAO members, including non-US members, may object to this given their individual circumstances, the reality is that:

- The DAO was founded by Zora, a US company

- Nouns Builder Protocol was originally built by Zora

- Additional members and distribution recipients are likely to be US-based.

Thus, a regulator like the IRS examining the DAO’s activities is likely to conclude the DAO has a US nexus and is subject to US jurisdiction. It was therefore important to adopt a structure that protects members from the implications of US jurisdiction. The important point here is that it is the DAO’s activities (generating revenue, making payments, membership) that create US exposure, not the legal structure. However, the legal structure can help alleviate some of the compliance risk and complexity.

Summary of Research and Analysis

In our review, we examined the following DAO structure options: Entityless, Ownership Foreign Foundations, and a number of US-based options (including the C-Corp, LLC, Limited Cooperative Associations, and UNA). For descriptions of each of these models and their respective characteristics, please see Paradigm’s DAO Entity Matrix and a16z’s DAO Entity Selection Framework Flowchart.

Each of these approaches has benefits and may make sense for certain DAOs - our intention here is not to cast judgment. The following analysis instead focuses on our prioritized DAO characteristics above:

-

Entityless - While entityless DAOs are cheap, decentralized, and support anon membership, they present significant risk to individual members. If a DAO does not choose an entity structure, a government or regulator will choose it for you. In the US, an entityless DAO has a significant likelihood of being considered a partnership, where each member of the DAO is potentially personally liable for the actions of the DAO and the DAO’s tax liability (i.e. the IRS can go after your personal bank account to pay the DAO’s taxes). We are already seeing a potential version of this risk play out in the CFTC’s action against OokiDAO. In addition, an entityless is unable to enter into contracts with service providers or engage in other real world activity, like hiring employees.

-

Ownerless Foreign Foundation - Foreign Foundations can provide significant tax benefits to DAOs where the DAO and Foundation operations are based outside of the US, and can potentially provide liability protection to the Foundation and the ability to enter into contracts. However, Foreign Foundations have a number of drawbacks. First, they are very expensive to set up, (potentially costing in the six figures to establish and operate) as they require potential local registration and the appointment of Directors and Managers to manage the Foundation. Second, certain decision-making authority is centralized in the managers in an off-chain manner (i.e. DAO votes are “recommendations” to the managers, but the managers ultimately determine whether or not to execute a given vote. If the managers determine that executing the vote is not in the best interests of the Foundation, they are within their rights to decline to execute the vote). Third, Foundations sit separate from the DAO itself, so DAO members themselves may not have liability protection, only the managers. Fourth, if a DAO has significant US presence, that US activity is still subject to US tax and is not protected by the Foreign Foundation’s tax beneficial model. In fact, if the foreign model is deemed to be an attempt to avoid US taxes, the DAO/Foundation could face potential penalties.

- We note that many early and prominent DAO projects adopted this model. While we don’t want to speculate, it may be that V1 DAOs issuing fungible governance tokens with pre-sales and set allocations did so to address other issues (e.g. securities laws) that are not as relevant to Builder DAO given its token rights and distribution model. In other cases, the DAO operations may be sufficiently offshore to take full advantage of the benefits of this model.

-

US C-Corp - C-Corps provide clear liability protection, ability to contract, tax clarity, and fluid membership. They also are well structured for DAOs seeking traditional VC investment (not relevant here). However, C-Corps require a Board of Directors subject to fiduciary duties, where decision-making and authority is centralized, This limits pure onchain governance. Like most US entities, C-Corps are also subject to revenue taxation and info collection/reporting.

-

US LLC - US LLCs check many of our priority boxes - they are cheap, simple, flexible, provide limited liability protection and the option for corporate taxation, support onchain governance through member-managed LLCs, and allow the DAO to engage in real world activity. However, due to recent changes in US corporate transparency laws requiring LLCs to report their beneficial ownership, members of LLCs likely have to doxx themselves. LLCs are also subject to revenue taxation and info collection/reporting.

-

US LCA - While LCAs provide corporate personhood and liability protection, they carry the same information disclosure concerns as LLCs. They are also a fairly novel organizational model.

-

US UNA - The UNA is a model limited to DAOs who serve a nonprofit purpose (meaning members are not entitled to profits of the organization, with some limited exceptions). Provided this requirement (which also helps alleviate securities risk) is met, UNAs provide almost all of the benefits we are seeking. They: 1) provide limited liability protection; 2) support anonymous membership; 3) are cheap and simple to set up (they do not even require a formal filing to exist); 4) are flexible - standards and agreements between members can be governed by contract through the membership agreement; 5) if established in a state like Wyoming, allow the DAO to own physical property and engage in other real world activity; 6) support direct onchain and decentralized governance; 7) allow for taxation as C-corps, protecting members from individual liability; and 8) as nonprofits, have a shot to qualify for tax exempt status as 501(c)(3)s or 501(c)(4)s (though this may require member doxxing and sacrificing some decentralization). On the flip side, they are subject to US tax and information collection obligations, and are a relatively new organizational model that has not been tested in courts as applied to DAOs.

Why the UNA Makes Sense

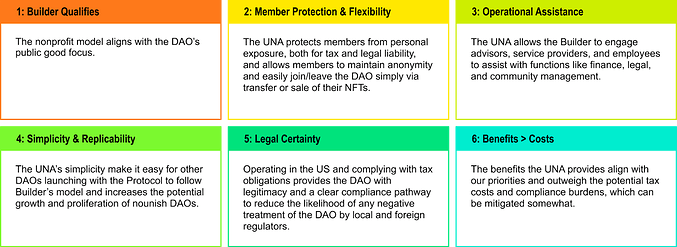

We proposed the UNA structure for Builder DAO for the following reasons:

Additional Tax Considerations

Members have raised questions about two key implications of the US structure that we address in turn:

1. Taxation of DAO revenues, including the 1000ETH seed funds

As a US entity that is not currently tax exempt, the UNA’s gains are subject to, at a minimum, federal income tax. However, this liability can be mitigated in a few ways:

-

Net Liability - Tax liability is on net gains, meaning revenues minus expenses. The DAO’s payouts will generally be considered expenses. So if in a given year the DAO’s payouts equal or exceed its revenues (from auctions or otherwise), the DAO will not have tax liability on gains. Its losses can also be carried forward against gains in future years.

-

Tax Year End - The seed funds were received in 2022. However, because the DAO launched close to the end of the year and requires time to set up its financial reporting framework, the DAO may potentially set its year end in June rather than December. If so, the seed funds may be netted against payments made in the first half of 2023.

We are working with accountants on these points and will provide updates until the DAO is able to onboard its own accountants directly.

2. Information Collection for Payout Recipients

This requirement was outlined in detail in the FAQ circulated to DAO members, but we wanted to clarify a few things:

-

Recipients Only - This obligation only applies to funds recipients, not all DAO members.

-

Contributor Entities - To prevent having to provide personal information, a contributor (or a team) can create an LLC for their provision of services. LLCs are cheap and simple to set up, can set their address to be that of a registered agent, and have a public tax-ID number (an EIN), so no PII has to be shared. There are lots of services that help with LLC setup (e.g. Opolis, Doola, Stripe Atlas)

-

Need to Know Access - As discussed, the goal is to set up a framework where any provided information is only accessed by bookkeeping service providers solely to execute the DAO’s information reporting requirements. Information should not be accessible to other members.

What’s Next

-

Disclosures - We have published disclaimers regarding the UNA structure here, and will submit a proposal to add a shorter disclosure on the “About”” section of Builder DAO’s homepage on the Nouns Builder interface to keep prospective members informed about the UNA.

-

Admin Authorization - David plans to submit a proposal requesting admin authorization to engage consultants (e.g. lawyers and accountants) to represent the DAO directly and finalize the administrative setup for the UNAin Wyoming. We believe this initiative is important regardless of sentiments about the UNA as it allows the DAO to engage third party advisors.

-

Prop House - The next round of Prop House kicked off today. That process will take about 4 weeks before winners are decided, during which time we will continue working with the DAO on a reasonable information collection method.

-

Ongoing Research - Legal treatment of DAOs remains a relatively new and evolving space, and we’ll continue working with advisors on tax planning and entity structure analysis.

We hope this answers members’ key questions about the UNA and we look forward to further discussion.